Aug 28 (Reuters) - The S&P 500 and Dow Jones Industrial Average notched record high closes on Thursday after Nvidia's quarterly report fell short of investors' high expectations but confirmed that spending related to artificial intelligence infrastructure remains strong.

Shares of Nvidia (NVDA.O), dipped 0.8% after Sino-U.S. trade uncertainties prompted the leading AI chip designer to exclude potential China sales from its quarterly forecast late on Wednesday.

Investors viewed Nvidia's report, including a 56% surge in quarterly revenue, as confirmation that demand related to AI technology remains strong, supporting a rally in AI-related stocks that has propelled Wall Street to record highs in recent years.

Other AI heavyweights gained, with Alphabet (GOOGL.O), adding 2%, Amazon (AMZN.O), up 1% and chipmaker Broadcom (AVGO.O), rising almost 3%.

"Nvidia is such an outlier that to say it was a disappointing print is only against the bar of borderline impossible expectations," said Ross Mayfield, an investment strategy analyst at Baird. "It's clear that the primary structural driver of this market, which is AI, is not going anywhere or cooling down."

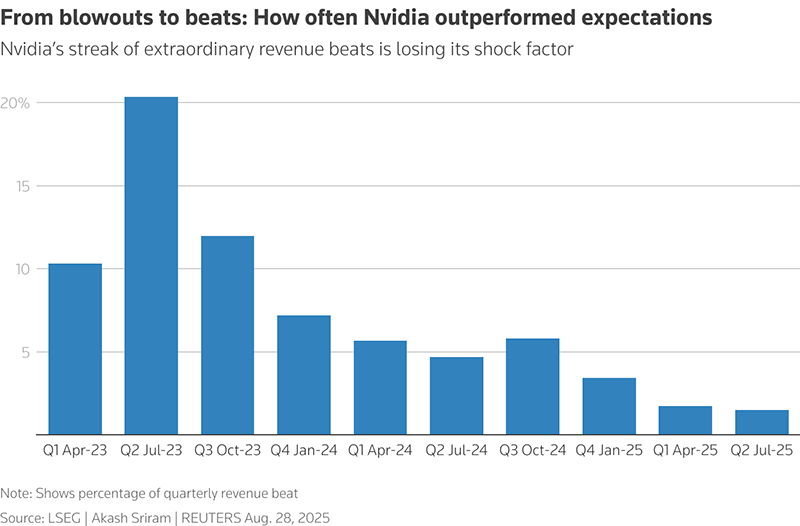

From blowouts to beats: How often Nvidia outperformed expectations - Nvidia’s streak of extraordinary revenue beats is losing its shock factor

The S&P 500 climbed 0.32% to end the session at 6,501.86 points, reaching a record high close for a second straight day.

The Nasdaq gained 0.53% to 21,705.16 points, while the Dow Jones Industrial Average rose 0.16% to 45,636.90 points, exceeding its previous record high close on August 22.

Seven of the 11 S&P 500 sector indexes rose, led by communication services (.SPLRCL), up 0.94%, followed by a 0.68% gain in energy (.SPNY).

Nike (NKE.N), slid 0.2% after the sports apparel seller said it was cutting less than 1% of its corporate workforce as it struggles to reclaim market share lost to rivals.

Traders work on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., August 26, 2025. REUTERS/Brendan McDermid/File Photo

Reducing worries of a slowing economy, weekly jobless claims were lower than expected, while a separate report showed corporate profits rebounded in the second quarter.

Expectations that the Federal Reserve will soon cut interest rates to shore up economic growth have contributed to Wall Street's recent gains.

Investors on Friday will focus on Personal Consumption Expenditures data. Any signs of inflation increasing could temper broad expectations for easing at the Fed's policy meeting in September.

Traders are pricing in more than an 80% chance of an interest rate cut next month, according to CME Group's FedWatch.

On Thursday, Fed Governor Lisa Cook filed a lawsuit challenging U.S. President Donald Trump's attempt to remove her from office earlier this week.

Data analytics company Snowflake (SNOW.N) surged 20% after raising its forecast for fiscal 2026 product revenue, citing AI demand.

HP Inc (HPQ.N), rose 4.6% after beating quarterly revenue estimates on growing demand for AI-powered personal computers.

Packaging food company Hormel Foods (HRL.N), tumbled 13% after issuing a downbeat quarterly profit forecast.

Declining stocks outnumbered rising ones within the S&P 500 (.AD.SPX), by a 1.2-to-one ratio.

The S&P 500 posted 28 new highs and five new lows; the Nasdaq recorded 117 new highs and 52 new lows.

Volume on U.S. exchanges was relatively light, with 13.8 billion shares traded, compared to an average of 16.7 billion shares over the previous 20 sessions.

Reporting by Johann M Cherian and Sanchayaita Roy in Bengaluru, and by Noel Randewich in San Francisco; Editing by Devika Syamnath and Richard Chang